Using temporary car insurance documents for taxing a car is easy, you can visit the Driver and Vehicle Licensing Agency (DVLA) website. To tax cars online, the temporary car insurance documents are updated on the Motor Insurance Database (MID) website. To tax your car offline, you can visit any local post office. To tax your car offline, you will have to carry details and documents to the local post office with you.

In the United Kingdom, cars can not be taxed without insurance. The United Kingdom law accepts temporary car insurance to tax a car as long as it shows as insured on the Motor Insurance Database (MID). So as long as your insurance details are updated in MID, there is nothing to worry about. The UK government goes through the details, so you don’t need insurance details in hand while taxing the vehicle. Just remember that it can take a few days for the MID to be updated even if you are already insured! So your temporary insurance might already have expired by the time it is updated.

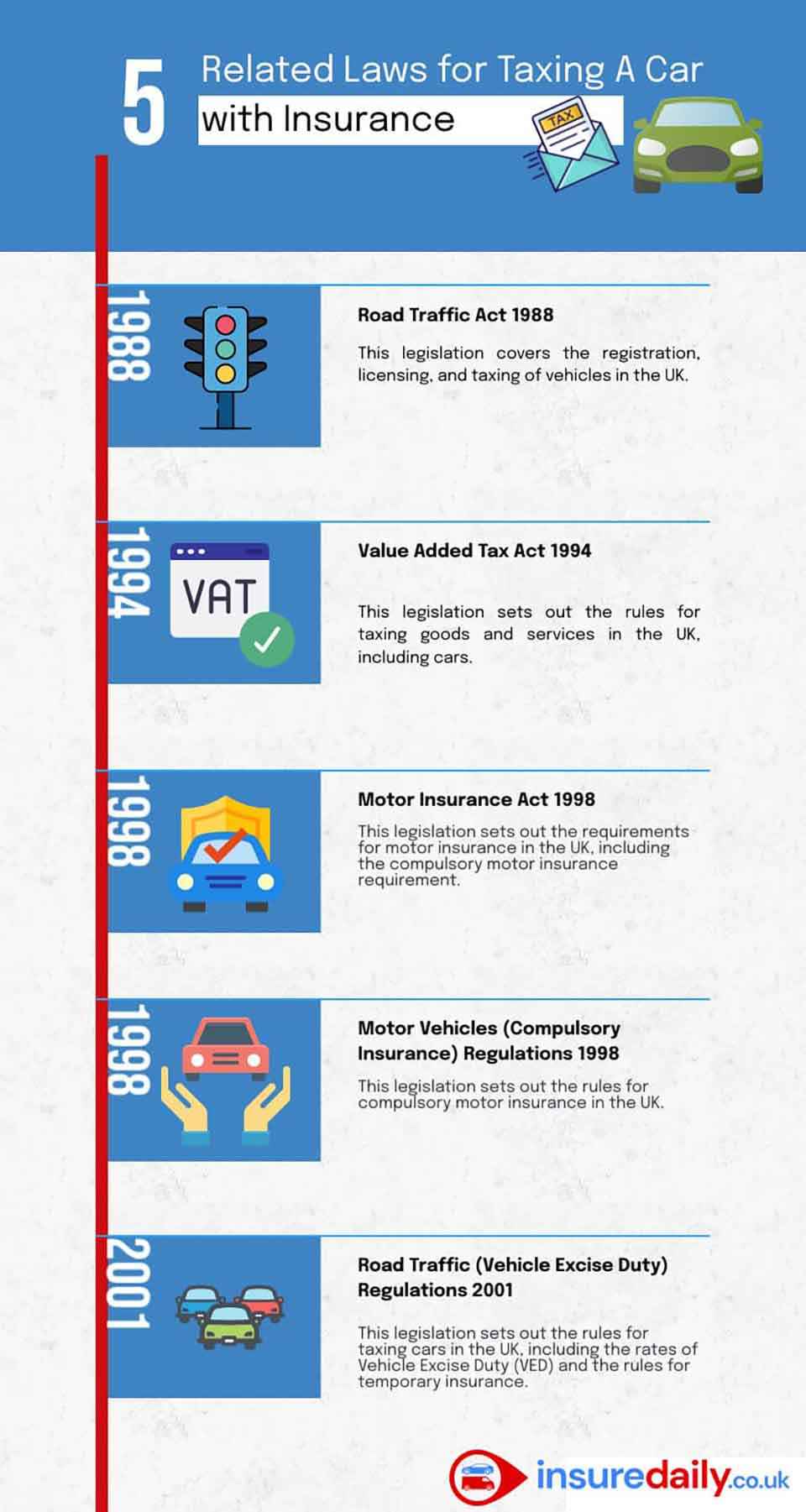

It is a legal requirement for all cars to have valid insurance in order to tax a car. A car must be taxed to legally drive it on public roads. If a car is not taxed, you may get fined £80. Insurance is still valid without tax, but you will have to confirm that with your insurance company. You do not need to tax a car if you do not plan to drive it and park it on public roads. But you will have to declare it Statutory Off Road Notification (SORN). Road Traffic Act 1988: This legislation covers the registration, licensing, and taxing of vehicles in the UK. Value Added Tax Act 1994: This legislation sets out the rules for taxing goods and services in the UK, including cars. Motor Insurance Act 1998: This legislation sets out the requirements for motor insurance in the UK, including the compulsory motor insurance requirement. Road Traffic (Vehicle Excise Duty) Regulations 2001: This legislation sets out the rules for taxing cars in the UK, including the rates of Vehicle Excise Duty (VED) and the rules for temporary insurance. Motor Vehicles (Compulsory Insurance) Regulations 1998: This legislation sets out the rules for compulsory motor insurance in the UK.

You can tax your car with temporary car insurance, but there are a few things you need to consider. Firstly, you need to be covered for the period that you are purchasing the tax to start on. In order to tax your vehicle, it will also need to show as insured on the MID (Motor Insurance Database), and this can take some time to show, so you will not be able to tax your vehicle unless it shows as insured on the MID. There are things to know about taxing a car with temporary car insurance. These are listed below. Temporary car insurance is flexible and covers you from a couple of hours to a couple of days. Sometimes, the temporary car insurance details are not updated on Motor Insurance Database (MID). It can take a couple of hours to show the temporary car insurance details on the website. The UK government law states that car insurance details need to be on MID within 7 days.

It is not possible to get a temporary road tax in the UK. The UK government requires you to pay car tax for either 6 months or 12 months. However, car tax can be paid whilst using temporary car insurance.

You can read our full blog page to find out more about road tax and temporary insurance.