Taxing a Car With Temporary Car Insurance in 2024

In the UK, you can tax a car with temporary car insurance. Taxing a car with temporary car insurance is allowed once the Motor Insurance Database (MID) is updated to confirm the vehicle is insured. The tax authorities in the UK government check the Motor Insurance Database before taxing a car. A car can be taxed on short-term or long-term car insurance. The UK government requires all vehicles to be taxed and insured at all times when they are on the roads. Cars that are not kept on the road must have a Statutory Off Road Notification (SORN). If you are thinking about short-term or temporary car insurance, then a temporary car insurance policy is a great option. Taxing a vehicle with a temporary policy is an easy and straightforward process. You can tax your vehicle with a short-term car insurance policy on the Driver and Vehicle Licensing Agency (DVLA) website or at your local post office. Car Tax is a tax that the UK government requires you to pay to use vehicles on public roads. The UK government has set specific criteria for the amount of tax that needs to be paid. This amount of tax depends on the CO2 emissions of the vehicle. The higher the CO2 emissions, the higher the tax will be. For example, if the CO2 emission is 0g/km, the first tax payment is £0. If CO2 emission is between 1g to 50g/km, the tax will be between £10 and £25 per year, depending on what fuel your car uses. If the CO2 emission is between 51g to 75g/km, the tax rate will be between £15 to £120 per year. Diesel cars that do not fit into the Real Driving Emissions 2 (RDE2) standard for Nitrogen Oxide (NO) have to pay higher rates. Electric cars do not need to pay car taxes. From the second tax payment onwards, the tax rate for petrol and diesel cars is £165 for a single 12-month payment. The tax rate can go up to £173.25 for total monthly payments. The tax rate for alternative fuel is between £155 and 162.75 for 12 months. This depends on whether you opt for a single 12-month payment method or a monthly payment by direct debit.

How to Use your Temporary Car Insurance Documents for Taxing a Car

Using temporary car insurance documents for taxing a car is easy, you can visit the Driver and Vehicle Licensing Agency (DVLA) website. To tax cars online, the temporary car insurance documents are updated on the Motor Insurance Database (MID) website. To tax your car offline, you can visit any local post office. To tax your car offline, you will have to carry details and documents to the local post office with you.

What does United Kingdom Law say about Taxing a Car with Temporary Car Insurance?

In the United Kingdom, cars can not be taxed without insurance. The United Kingdom law accepts temporary car insurance to tax a car as long as it shows as insured on the Motor Insurance Database (MID). So as long as your insurance details are updated in MID, there is nothing to worry about. The UK government goes through the details, so you don’t need insurance details in hand while taxing the vehicle.

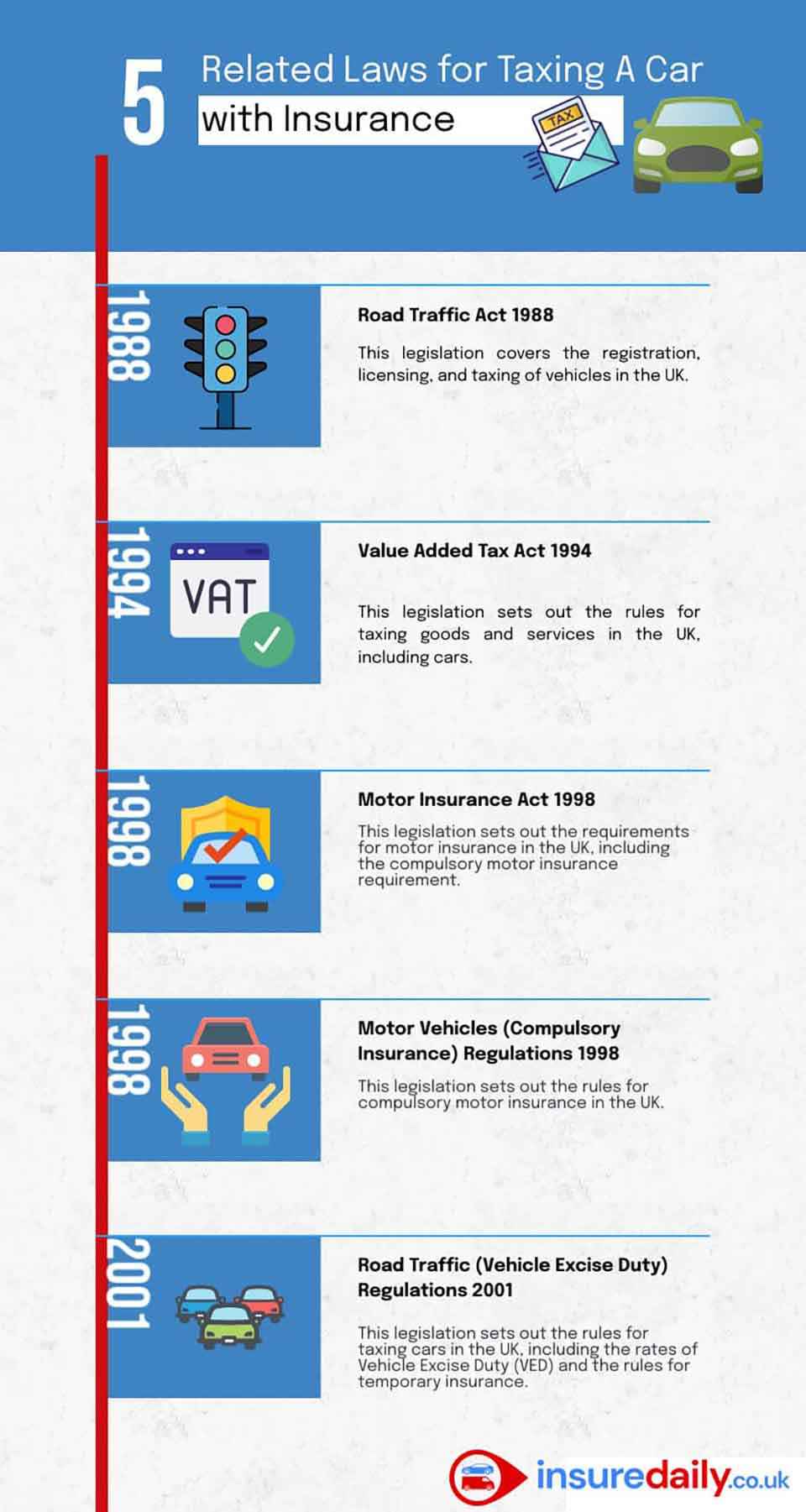

What are the related Laws for Taxing a Car with Insurance?

It is a legal requirement for all cars to have valid insurance in order to tax a car. A car must be taxed to legally drive it on public roads. If a car is not taxed, you may get fined £80. Insurance is still valid without tax, but you will have to confirm that with your insurance company. You do not need to tax a car if you do not plan to drive it and park it on public roads. But you will have to declare it Statutory Off Road Notification (SORN). Road Traffic Act 1988: This legislation covers the registration, licensing, and taxing of vehicles in the UK. Value Added Tax Act 1994: This legislation sets out the rules for taxing goods and services in the UK, including cars. Motor Insurance Act 1998: This legislation sets out the requirements for motor insurance in the UK, including the compulsory motor insurance requirement. Road Traffic (Vehicle Excise Duty) Regulations 2001: This legislation sets out the rules for taxing cars in the UK, including the rates of Vehicle Excise Duty (VED) and the rules for temporary insurance. Motor Vehicles (Compulsory Insurance) Regulations 1998: This legislation sets out the rules for compulsory motor insurance in the UK. (Reword this - explanations)

What to know about taxing a car with temporary car insurance?

You can tax your car with temporary car insurance, but there are a few things you need to consider. Firstly, you need to be covered for the period that you are purchasing the tax to start on. In order to tax your vehicle, it will also need to show as insured on the MID (Motor Insurance Database), and this can take some time to show, so you will not be able to tax your vehicle unless it shows as insured on the MID. There are things to know about taxing a car with temporary car insurance. These are listed below. Temporary car insurance is flexible and covers you from a couple of hours to a couple of days. Sometimes, the temporary car insurance details are not updated on Motor Insurance Database (MID). It can take a couple of hours to show the temporary car insurance details on the website. The UK government law states that car insurance details need to be on MID within 7 days.

What is the relation between Temporary Road Tax and Temporary Car Insurance?

It is not possible to get a temporary road tax in the UK. The UK government requires you to pay car tax for either 6 months or 12 months. However, car tax can be paid whilst using temporary car insurance.

Can I tax a car with the previous car owner's temporary car insurance?

You can not tax a car with the previous owner’s temporary car insurance, as the insurance needs to be in your name to tax a car, whether it is temporary insurance or annual insurance... A previous car owner’s temporary car insurance can’t cover a new owner.Can I drive a car without road tax?

According to UK law, you can not drive a car without it being insured and taxed. The UK law allows not paying tax only when the car is declared Statutory Off Road Notification (SORN).

Do I need to tax a car if it is not being driven?

You do not need to tax a car if it is not driven and parked on public roads. However, if a car is not being driven, you have to declare it Statutory Off Road Notification (SORN). If you park your car on public roads, you may have to tax it.

What is the penalty for driving a car without paying road tax in the UK?

If you drive a car without paying road tax, a penalty of £80 may be applicable. If you fail to pay the first £80 penalty, it can rise to £1000.

What happens with car tax while buying a new car from someone else?

Car tax can no longer be transferred from the previous owner to the new owner. That means the new owner must pay the car tax. The V5C details get transferred from the previous owner to the new owner. After that, the new owner must insure the car and pay tax. Usually, car dealers sort the first tax payment and registration charges for new owners. Car dealers give new owner’s details to Driver and Vehicle Licensing Agency (DVLA).

How to Understand whether my road tax is due or not?

You can log on to the UK government website to check if your road tax is due or not. If your road tax is due and if you have not opted for direct debit payments, then the Driver and Vehicle Licensing Agency (DVLA) will send you a V11, which is a vehicle tax reminder letter. If you have opted for direct debit payments, then your payments for your road tax will be deducted automatically, and you will not be sent V11.